Whether operating as an LLC, a corporation or other entity, a family business with multiple owners has two potential areas of conflict – business and family.

This includes how the shareholder agreement fits into estate planning. The term “shareholder agreement” is used to refer any multiple-owner agreement, whether the entity is structured as a corporation, an LLC or some other form.This is not intended to be a facetious statement but to illustrate that a family business needs to address the same potential conflicts that any small closely held business must address, as well as some additional considerations caused by family relations.

Closely held businesses seek to restrict transfer of ownership outside of a selected circle of potential owners. A primary reason for this is so that existing owners have control over who they are in business with. A mom-and-pop business may want only family members to be involved, not strangers.

How can outsiders get involved?

1. A family owner could transfer the business interest to an outsider.

2. A family owner could die – death causes the interest of the owner to pass to whoever takes that owner’s estate.

3. An owner’s creditors, or a bankruptcy trustee if the owner files personal bankruptcy, could come after the owner’s interest as an asset that could be seized and sold to pay debts.

4. An owner who goes through a divorce could find the divorce court has awarded his or her interest, partly or entirely, to the owner’s spouse. These potential transfer issues raise touchy questions about whether permitted owners should include in-laws who become “exes.”

To control who can be future owners in a closely held family business, shareholder agreements typically restrict transfers to a defined group or require that the shares be offered to the existing company or its shareholders before being voluntarily or involuntarily transferred.

Such arrangements should address how to value the interest for purposes of the buyout. This is very important because certain methods of valuation could be highly unfair to the person being bought out.

Consider potential sources of funding a buyout and a time frame over which the option to purchase can be exercised and completed without hurting the company’s cash flow too much. Life insurance often is used to fund buyouts triggered by the death of an owner.

Another set of provisions, called “tag along” rights, protects the rights of minority owners in the event sales to third parties that are allowed by the agreement are contemplated.

With tag along, if a majority shareholder wants to sell to a third party, minority shareholders have the right to “tag along” by selling under the same terms.

There also can be provisions called “drag along,” under which a majority shareholder who wishes to sell can force sale of the minority interests on the same terms so that full ownership of the company can be delivered to the prospective purchaser.

Shareholders in any small company should be concerned about control. Provisions in shareholder agreements can require that key decisions, such as incurring significant debt, providing salaries or declaring dividends, requires unanimity or a supermajority.

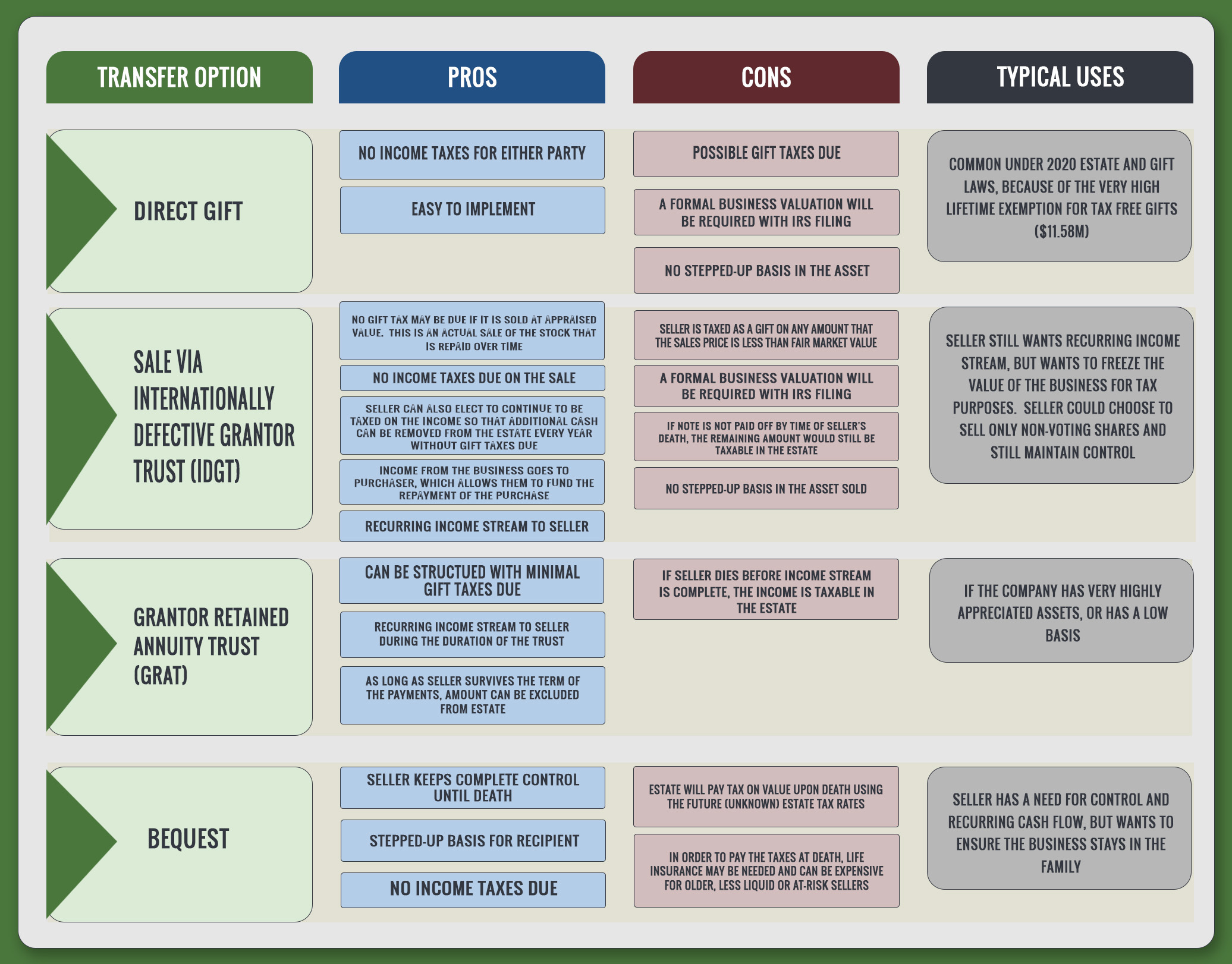

Control issues can become more complicated when families throw estate planning into the mix. For example, one way to reduce federal estate tax is to reduce what you own through lifetime gifts to family members over a period of time.

The result is that at the time of your death, you will own a smaller percentage of the business, so there will be less for the IRS to tax. However, how does that affect control? The client may want to keep control while simultaneously decreasing ownership or even becoming a minority owner.

Especially challenging is the situation in which the family business is the major asset of the family but not the major concern of all the family members.

Suppose Donald Duck wishes to leave Donald Duck Enterprises to his children Huey, Dewey and Louie. However, Huey is the only one who is interested in and actively works in the business. How can Donald share the benefit of the business with all three equally but leave practical control to just Huey?

Family businesses have the same buyout and control concerns as any small, closely held business and may have additional concerns that arise from estate planning or other family relation factors. For this reason, a well-drafted shareholder agreement addressing all concerns is essential to minimize future conflict.

If your business received a PPP loan, you may be eligible to have that loan forgiven. Our team can help you ensure that your loan forgiveness application is filed correctly and timely. Complete our five-question form, and we can provide a quote for your application by the next business day.

Request a Quote