News

415 Group News

415 Group Grows By 9 New Team Members

2/28/2024

415 Group is equipped with nine new employees to handle the influx of business.

READ MORE >

415 Group One of “America’s Most Recommended Tax Firms”

2/27/2024

Local Firm in Top 100 on Exclusive List

415 Group has been named one of the most recommended tax firms in the country by USA TODAY and Statista. The firm was one of only 100 nationwide to make the list.

National Ranking

This is the...

READ MORE >

Keep a Close Eye on the Tax Relief for American Families and Workers Act of 2024

1/24/2024

Businesses and individuals alike need to keep a close eye on current pending tax legislation that has bipartisan and bicameral support on Capitol Hill. This much needed legislation is several years in the making. Since the Tax Cuts and Jobs Act...

Includes insights from Raymond A. Maynard

READ MORE >

415 Group Announces New Partner and Eight Additional Promotions

12/22/2023

415 Group, the largest locally owned public accounting and IT consulting firm in Stark County, Ohio, announced nine promotions, including Todd Ruggles to partner.

Todd Ruggles, CPA, Tax Partner

Todd Ruggles has been...

READ MORE >

415 Group Grows by 13 New Team Members

10/30/2023

415 Group, the largest locally owned public accounting and IT consulting firm in Stark County, announced 13 new hires today. The accounting and operations departments grew by eight, while the IT department grew by three and 415 Access by...

READ MORE >

415 Group Named Top 300 Firm by INSIDE Public Accounting

8/21/2023

415 Group, the largest locally owned public accounting and IT consulting firm in Stark County, has once again been named a top accounting firm in U.S. by INSIDE Public Accounting (IPA).

This year, the firm was named to the top 300 list...

READ MORE >

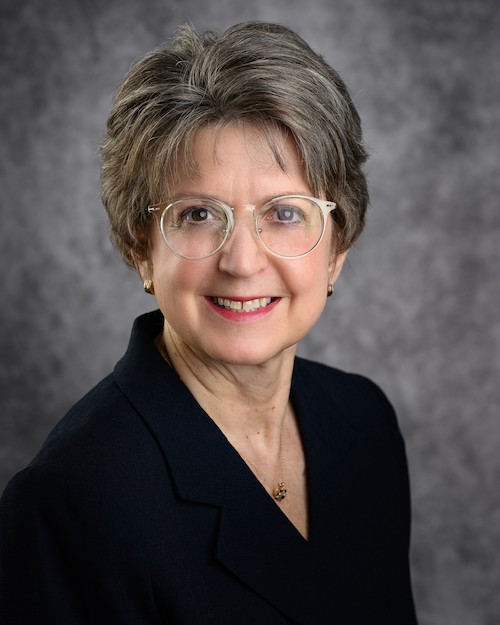

415 Group Appoints Natalie Simmons to Partner in Charge of Tax

7/18/2023

415 Group, the largest locally owned public accounting and IT consulting firm in Stark County, based in Canton, Ohio, has appointed Natalie Simmons to partner in charge of tax.

Tax services make up the firm’s largest division....

READ MORE >

415 Group Awarded Sixth Top Workplaces 2023 Honor

6/26/2023

415 Group, a certified public accounting, business consulting and IT services firm, has been awarded a Top Workplaces 2023 honor by cleveland.com and The Plain Dealer Top Workplaces. This is the sixth Top Workplaces award the firm has...

READ MORE >

Barb Karch Named New Director of 415 Access

5/1/2023

415 Group, the largest locally owned public accounting and IT consulting firm in Stark County, based in Canton, Ohio, named Barb Karch as their new 415 Access director.

As director of 415 Access, Karch will manage a team of 10 accountants. 415...

READ MORE >

415 Group Named One of Top Accounting Firms by Accounting Today

3/29/2023

415 Group, the largest locally owned public accounting and IT consulting firm in Stark County, based in Canton, Ohio, was named to Accounting Today’s list of Top Firms in their Great Lakes region. The rankings are compiled based on 2022 firm...

READ MORE >

415 Group Promotes 8 Team Members, Including 1 New Partner

12/16/2022

415 Group, the largest locally owned public accounting and IT consulting firm in Stark County, announced the promotion of Eric Schreiber to partner, along with seven additional promotions for other team members.

“Eric joined 415 Group with...

READ MORE >

415 Group Named to Forbes 2023 Best Tax & Accounting Firms

12/15/2022

2023 List Marks Third Consecutive Year for Canton-Based Firm

415 Group, the largest locally owned public accounting and IT consulting firm in Stark County, based in Canton, Ohio, was recognized by Forbes as one of America’s Best Tax and...

READ MORE >

415 Group Adds 8 Team Members to Northeast Ohio Accounting Firm

11/29/2022

415 Group, a leading accounting firm that for 40 years has been helping Northeast Ohio companies grow their businesses, announced eight new hires today. The accounting department grew by four, the IT department by one and 415 Access by three. 415...

READ MORE >

415 Group Named a Top U.S. Accounting Firm by INSIDE Public Accounting

8/23/2022

415 Group, the largest locally owned public accounting and IT consulting firm in Stark County, was recognized by INSIDE Public Accounting (IPA) as a top accounting firm in the United States. In 2022, IPA named 415 Group both an IPA 400 Firm (#307...

READ MORE >

415 Group Expands Canton Location

7/26/2022

CANTON, OH (July 26, 2022) — 415 Group, a certified public accounting, business consulting and IT services firm, announced the expansion of their main Canton location. The firm added another floor of offices to their...

READ MORE >

415 Group Awarded a Northeast Ohio Top Workplaces 2022 Honor

6/27/2022

Canton, Ohio, June 26, 2022 - 415 Group, a certified public accounting, business consulting and IT services firm, has received its fifth Top Workplaces award by cleveland.com and The Plain Dealer.

“We are incredibly...

READ MORE >

415 Group Adds 9 Team Members to Firm & New Division

6/24/2022

415 Group, a leading accounting firm that for 40 years has been helping Northeast Ohio companies grow their businesses, announced nine new hires today. Both the accounting and IT departments added three team members, and 415 Access—the...

READ MORE >

415 Group to Celebrate Alliance Office Opening

5/25/2022

CANTON, OH (May 25, 2022) — 415 Group, a certified public accounting, business consulting and IT services firm, will co-host a Business After Hours event on June 2, 2022, from 5 to 7 p.m. at 960 West State Street, Alliance,...

READ MORE >

415 Access frees up business owners to grow their businesses

2/28/2022

CANTON, OH (February 28, 2022) — 415 Group, a leading accounting firm that for 40 years has been helping Northeast Ohio companies grow their businesses, today announced the creation of a virtual accounting solution that provides small- and...

READ MORE >

415 Group Opens Location in Alliance with Marcie Curry as Director

2/4/2022

ALLIANCE, OH (February 4, 2022) — 415 Group, a certified public accounting, business consulting and IT services firm based in Canton, Ohio, announced the opening of a new location this week, located at 960 W. State St.,...

READ MORE >