Running a business is difficult enough under the best circumstances. But family-owned enterprises are often complicated by an additional element – inactive family members.

Active and inactive are defined by company employment: The responsibility for the ongoing success and survival of the business rests upon those actively working for the company.

Problems can arise when inactive members second-guess or otherwise hamper smooth functioning operations and decision-making. In the worst-case scenarios, conflicts between family members can destroy the business, lead to litigation or necessitate selling it to outsiders.Active and inactive are defined by company employment: The responsibility for the ongoing success and survival of the business rests upon those actively working for the company.

There are many reasons why a family member might not be active in the family business. Perhaps it’s small and there aren’t many management slots. Or, their interests might lie elsewhere, in other careers. Or maybe they live across the country and their involvement isn’t feasible.

Under some definitions, inactive family members include spouses, children and other extended family, so the possibility of inactive family members outnumbering active family members is very real.

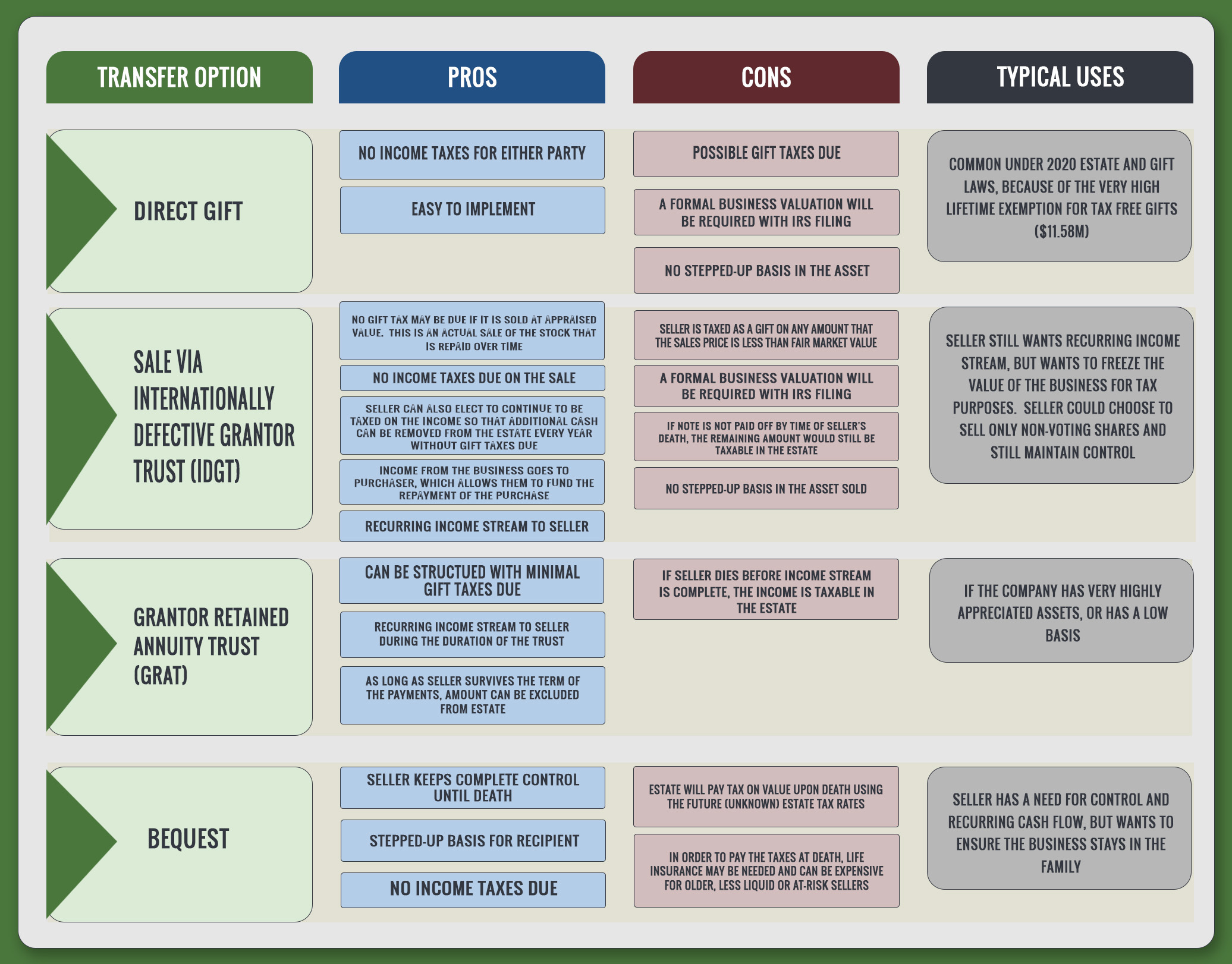

Assuming the company has a thoughtful succession plan and the right family members will take the helm, what can be done to mitigate problems? The first decision is how and what type of stock is awarded.

Many founders make the mistake of allowing fairness to override practicality. If voting stock is split between active and inactive siblings, how will the company function?

For example, banks often require majority stockholder votes to award loans. If inactive members vote against borrowing, the managing members are stuck. The issue is, how much control does the active member have in hiring, company direction, marketing, operations, etc. To be successful, they must be allowed to make decisions without consulting those who have none of the responsibility for outcomes or the daily headaches.

The danger is magnified when inactive members have no real understanding of business or the company, are risk averse, or are focused on the short term instead of the long term. Stage-of-life issues and personal financial needs may outweigh what is best for the business at times.

Voting control should be vested in those who have the ability to lead the company and are actively participating in company operations. Nonvoting stock is an option for passive members to benefit financially without hindering management. In situations where the estate has sizable assets outside the business, those are often awarded to nonactive family members in lieu of company interest.

At the same time, positive contributions from passive members shouldn’t be overlooked. In a family enterprise, those outside the company often have a vested interest in the identity and success of the company. Differing perspectives and experiences can enrich discussion of company direction. Nonactive members serving as an informal board of advisers can lend their expertise and help.

Ideally, the tone for active and nonactive family interaction should be set before generational transfer. This is a critical time in the business life cycle, and family dynamics are as likely to derail the company as financial and market issues. Creating consensus among the group regarding succession, leadership and operations will avert many issues down the road. Reinforcing why the company was founded, its values and benefit to the family will set a framework for cooperation.

To be most successful, this process needs to look at the business as a separate entity from the family, which may seem paradoxical. However, if the goal is for the enterprise to succeed then, like any business, it must be evaluated pragmatically, with an eye to its strengths, weaknesses, opportunities and needs. Like other organisms, businesses need to be nurtured and fed, not starved or drained of resources.

Once everyone is on board and committed to the continuance of the business, appropriate governance can be designed. This may include family councils or a board of advisers in addition to the company’s board of directors.

Clear lines of communication, the decision-making process and areas of responsibility need to be defined. Effort and compensations need to be linked but, at the same time, engaging the entire family can ensure another successful transition down the road. After all, the next generation of leaders may have parents who are inactive members today.

If your business received a PPP loan, you may be eligible to have that loan forgiven. Our team can help you ensure that your loan forgiveness application is filed correctly and timely. Complete our five-question form, and we can provide a quote for your application by the next business day.

Request a Quote