News

415 Group Insights

Helping business buyers and sellers with mergers and acquisitions

10/4/2021

As the average age of the business owner population rises, more business owners are planning for retirement. Since 2010, mergers and acquisitions have been on the rise and as we step out of 2020, these numbers have probably doubled.

Along with an...

Includes insights from Richard L. Craig

READ MORE >

Reasons Why You May Want to Opt Out of the Advance Child Tax Credit Payments

8/10/2021

Eligible parents have already started receiving advance child tax credit (CTC) payments from the federal government. The American Rescue Plan Act passed earlier this year included a one-year expansion of CTC payments, which increases the available...

Includes insights from Natalie M. Simmons

READ MORE >

How to Value a Company: Understanding Our Company Valuation Methods

3/30/2021

The success of buying or selling a company can hinge on the correct valuation. This is why it is so important to work with a firm that knows how to value a company.

We’re often asked, “What are the 3 ways to value a company?” At...

Includes insights from Richard L. Craig

READ MORE >

Educate yourself about the revised tax benefits for higher education

3/22/2021

Attending college is one of the biggest investments that parents and students ever make. If you or your child (or grandchild) attends (or plans to attend) an institution of higher learning, you may be eligible for tax breaks to help foot the...

Includes insights from Brian E. Raber

READ MORE >

The right entity choice: Should you convert from a C to an S corporation?

3/16/2021

The best choice of entity can affect your business in several ways, including the amount of your tax bill. In some cases, businesses decide to switch from one entity type to another. Although S corporations can provide substantial tax benefits over...

Includes insights from Raymond A. Maynard

READ MORE >

New law doubles business meal deductions and makes favorable PPP loan changes

1/29/2021

The COVID-19 relief bill, signed into law on December 27, 2020, provides a further response from the federal government to the pandemic. It also contains numerous tax breaks for businesses. Here are some highlights of the Consolidated...

Includes insights from Holly L. Lieser

READ MORE >

Why face-to-face meetings with your auditor are important

11/9/2020

Remote audit procedures can help streamline the audit process and protect the parties from health risks during the COVID-19 crisis. However, seeing people can be essential when it comes to identifying and assessing fraud risks during a financial...

Includes insights from Jeffrey S. Buckshaw

READ MORE >

The importance of partnering with a strong business valuation team

9/14/2020

One of the biggest misconceptions when it comes to business valuation involves multiples. Someone might hear that their friend or neighbor sold their business for a certain multiple of earning and based off of that amount, get an idea of their...

Includes insights from Dominic G. Reolfi

READ MORE >

Why Business Tax Services Should Go Beyond Basic Prep & Compliance

8/18/2020

When you own your own business, you pour everything into your vision and goals. Is your accountant doing the same? Or are you the one filing your taxes—doing the bare minimum while still following the law—and moving on to the next item...

Includes insights from Kathleen S. Krohn

READ MORE >

In times of economic hardship, businesses need a CPA now more than ever

8/6/2020

Chad Isler, 415 Group Partner, discusses the value a CPA partnership can bring to your business.

Includes insights from Chad R. Isler

READ MORE >

Take advantage of a “stepped-up basis” when you inherit property

8/4/2020

If you’re planning your estate, or you’ve recently inherited assets, you may be unsure of the “cost” (or “basis”) for tax purposes.

Fair market value rules

Under the fair market value basis rules (also known as...

Includes insights from Dominic G. Reolfi

READ MORE >

415 Group Helped Hundreds of Clients Work from Home

5/13/2020

Making the choice to work from home in the spring of 2019 probably wouldn’t have been a big deal, so long as your boss approved the decision and you could still get everything done. Yet when the coronavirus pandemic started in the spring of...

Includes insights from David H. Besse

READ MORE >

IRS Extends More Tax Deadlines to July 15

4/13/2020

The April 15 federal income tax filing due date has been moved to July 15, the U.S. Treasury Department and IRS recently announced. Here is what you need to know:

The due dates for all tax payments normally due April 15 have been pushed back 90...

READ MORE >

Setting up Your Business Accounting System

2/24/2020

You've done the hard work. You have a new business idea or you've found an existing business to purchase. Want to help ensure your business success? Pay attention to correctly set up your business accounting system. Here's how:

Consider a...

Includes insights from Dominic G. Reolfi

READ MORE >

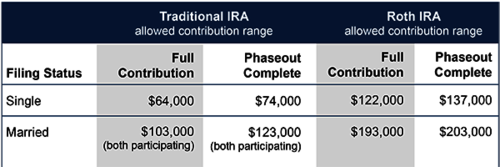

There's Still Time to Fund Your IRA

1/2/2020

There is still time to make a contribution to a traditional IRA or Roth IRA for the 2019 tax year. The annual contribution limit is $6,000 or $7,000 if you are age 50 or over.

Prior to making a contribution, if you (or your spouse) are an active...

READ MORE >

Save Money With These Year-End Ideas

12/5/2019

There's still time to reduce your potential tax obligation and save money this year (and next). Here are some ideas to consider:

Estimate your 2019 and 2020 taxable income. With these estimates you can determine which year receives the...

Includes insights from Holly L. Lieser

READ MORE >

Effective Tax Planning Starts Now

9/5/2019

With summertime activities in full swing, tax planning is probably not on the top of your to-do list. But putting it off creates a problem at the end of the year when there’s little time for changes to take effect. If you take the time to plan...

Includes insights from Todd J. Ruggles

READ MORE >

Laying the foundation for a successful succession plan

8/20/2019

As I prepare to retire from 415 Group this November, I’ve been reflecting on the succession process. When working in a service business like public accounting, you develop many personal relationships. These relationships, in many instances,...

Includes insights from Scott F. Whetstone

READ MORE >

How to Prepare for Your Business' Future Cash-Flow Gaps

8/16/2019

Ray Maynard, 415 Group Partner discusses how to get in front of your business' future cash-flow gaps.

Includes insights from Raymond A. Maynard

READ MORE >

Payroll Fraud Schemes Every Business Should Know

8/16/2019

According to the Association of Certified Fraud Examiners, nearly 30 percent of businesses are victims of payroll malfeasance, with small businesses twice as likely to be affected than large businesses. Here are four scary payroll fraud schemes you...

Includes insights from Matt D. Campanale

READ MORE >